what is suta tax texas

State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays. Nc Estimated Tax Payment Safe Harbor.

Twc Form C 3 Pdf Fill Online Printable Fillable Blank Pdffiller

A review of state unemployment laws reveals differences in eligibility.

. The wage base is to be 9000. When You Meet The Love Of Your Life Lyrics. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles employees to another business in order.

States use funds from SUTA tax to pay unemployment benefits to unemployed workers. The fund pays unemployment benefits to employees who have become unemployed at no fault of their own. File wage reports pay taxes more at Unemployment Tax Services.

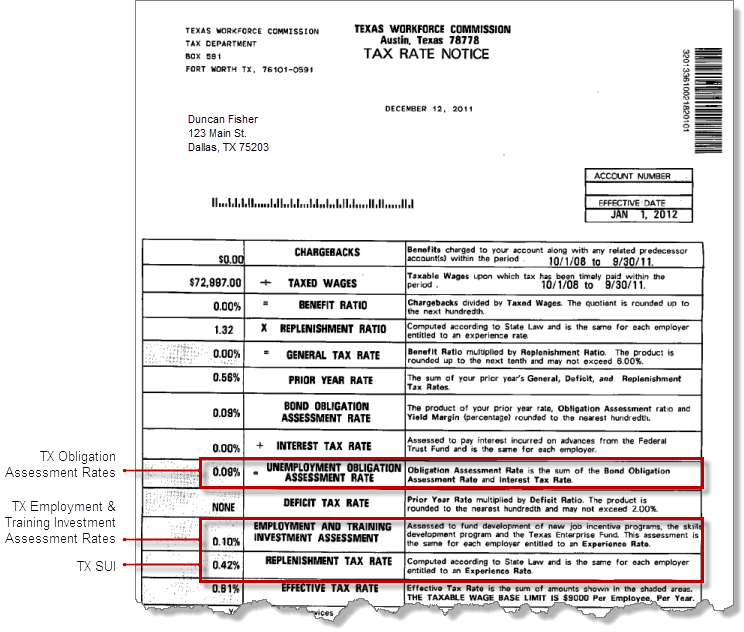

The states SUTA wage base is 7000 per employee. An employers SUI rate is the sum of five components. For the majority of states SUTA tax is an employer-only tax.

It is unlawful for employers to avoid a higher unemployment tax rate by altering their experience rating through transferring business operations to a successor. The 7000 is often referred to as the federal or FUTA wage base. However the money collected from the FUTA tax funds the federal governments oversight of each states individual unemployment insurance program.

Tax rates are to range from 031 to 631. The rate set is retroactive to January 1 for all employers. To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

1 2022 unemployment tax rates for experienced employers are to range from 031 to 631 the commission said in a news release. These taxes are put into the state unemployment fund and used by employees that lose their job through no fault of their own causing them to file for unemployment and collect their benefits. The yearly cost is divided by four and paid by quarter.

Restaurants In Wildwood Nj Open Year Round. Life Christian Academy Tuition. For example the SUTA tax rates in.

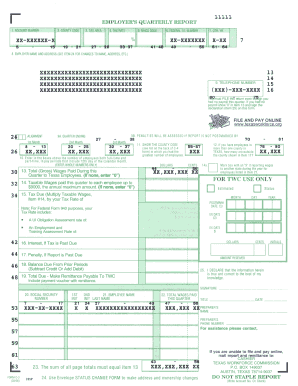

File Wage Reports Pay Your Unemployment Taxes Online. Famous Still Life Paintings Of Flowers. What is the current unemployment tax rate in Texas.

Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxesStaying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631. 52 rows SUTA the State Unemployment Tax Act is the state unemployment. Maximum Tax Rate for 2022 is 631 percent.

Your taxable wages are the sum of the wages you pay up to 9000 per employee per year. The Texas Workforce Commission TWC set the 2021 employers unemployment insurance UI tax rate in mid-June after a four-month delay as the state waited to see how the economic recovery progressed before setting Texas State Unemployment Tax Act SUTA Rates. You pay unemployment tax on the first 9000 that each employee earns during the calendar year.

Heres how an employer in Texas would calculate SUTA. Minimum Tax Rate for 2022 is 031 percent. SUTA is a tax paid by employers at the state level to fund their states unemployment insurance.

FUTA or Federal Unemployment Tax is a similar tax thats also paid by all employers. For pre-existing businesses the states determine. On the other hand self-employed individuals dont have an employer and must pay the entire percentage.

Posted by Employer Flexible on August 9 2021. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. What Is Suta Tax Texas.

The state unemployment tax act known as suta is a payroll tax employers are required to pay on behalf of their employees to their state unemployment fund. What is SUTA. Here are the basic rules for Texass UI tax.

30 2021 107 PM. Generally states have a range of unemployment tax rates for established employers. SUTA State Unemployment Tax Act is a payroll tax paid by all employers at the state level.

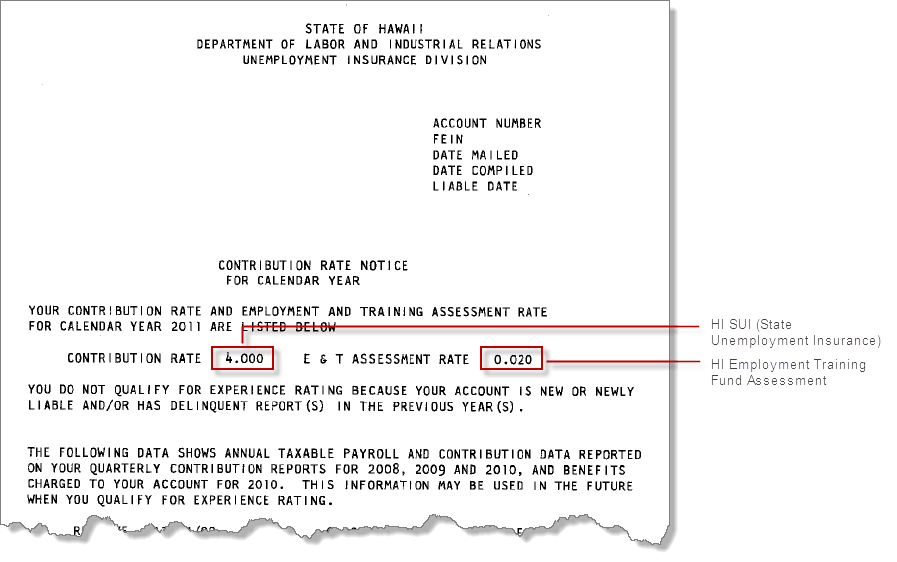

General Tax Rate Replenishment Tax Rate Unemployment Obligation Assessment Deficit Tax Rate and Employment and Training Investment Assessment. 52 rows Most states send employers a new SUTA tax rate each year. Do churches pay unemployment tax in Texas.

In Texas state UI tax is one of the primary taxes that employers must pay. Different states have different rules and rates for UI taxes. Can a priest collect unemployment.

Newly liable employers begin with a predetermined tax rate set by the Texas UI law. New businesses in texas start with a suta tax rate of 27. To find the SUTA.

Your 2022 Tax Rates Texas Workforce Commission. According to the IRS if you paid wages subject to state unemployment tax you may receive a credit of up to 54 of FUTA taxable wages when you file your Form 940. SUTA stands for State Unemployment Tax Act.

Unlike most other states Texas does not have state withholding taxes. What is SUTA. Self-employed individuals must pay a whopping 153 also known as the self-employment tax.

631 percent Since 2012 the Texas taxable wage base remains at 9000 for UI and the maximum UI Texas unemployment tax rate has fallen with the minimum going from 061 percent to 031 percent and the maximum falling from 758 percent to 631 percent. The FUTA tax rate is 6 and applies to the first 7000 paid to each employee as wages during the year. An employer usually pays the other half of the self-employment tax which is why employees only pay roughly 7 for FICA tax.

Since your business has. Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account chargeback details tax rate and adjust previously filed wage reports. Your state will assign you a rate within this range.

Texas unemployment tax rates are not to change for 2022 the state Workforce Commission said Nov. Each state establishes its own tax rate and wage base. However other important employer taxes not covered here include federal UI and withholding taxes.

9000 taxable wage base x 27 tax rate x number of employees Texas SUTA cost for the year. Churches associations of churches and religious schools are all exempt from paying both federal taxes under the Federal Unemployment Tax Act FUTA and state taxes under the Texas Unemployment Compensation Act TUCA. See Experience Rating Method.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. New businesses in Texas start with a SUTA tax rate of 27. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state.

What Is the SUTA Tax and Why Is It Going Up in 2021. Some states apply various formulas to determine the taxable wage base others use a percentage of the states average annual wage and many simply follow the FUTA wage base.

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

Better Homes And Gardens Country Home December 1985 General Store Page 112 Color Catalog Country House Better Homes And Gardens

Fast Unemployment Cost Facts For Texas First Nonprofit Companies

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

Futa Tax Overview How It Works How To Calculate

Payroll Software Solution For Texas Small Business

What Are Employer Taxes And Employee Taxes Gusto

Sui Sit Employment Taxes Explained Emptech Com

State Unemployment Insurance Sui Overview

The True Cost To Hire An Employee In Texas Infographic

2022 Federal State Payroll Tax Rates For Employers

Texas New Employer Information Patriot Software Small Business Success Payroll Small Business Owner

What Is The Federal Unemployment Tax Rate In 2020

Texas Workforce Commission C3dom Employer Fill Online Printable Fillable Blank Pdffiller